What is the tax rate for chemical energy storage projects

Welcome to our dedicated page for What is the tax rate for chemical energy storage projects ! Here, we have carefully selected a range of videos and relevant information about What is the tax rate for chemical energy storage projects , tailored to meet your interests and needs. Our services include high-quality What is the tax rate for chemical energy storage projects -related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

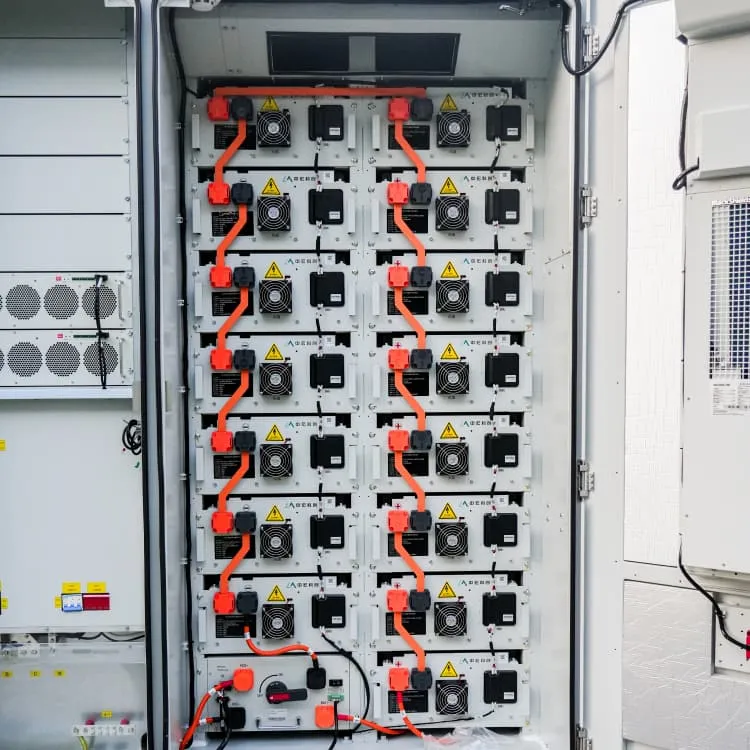

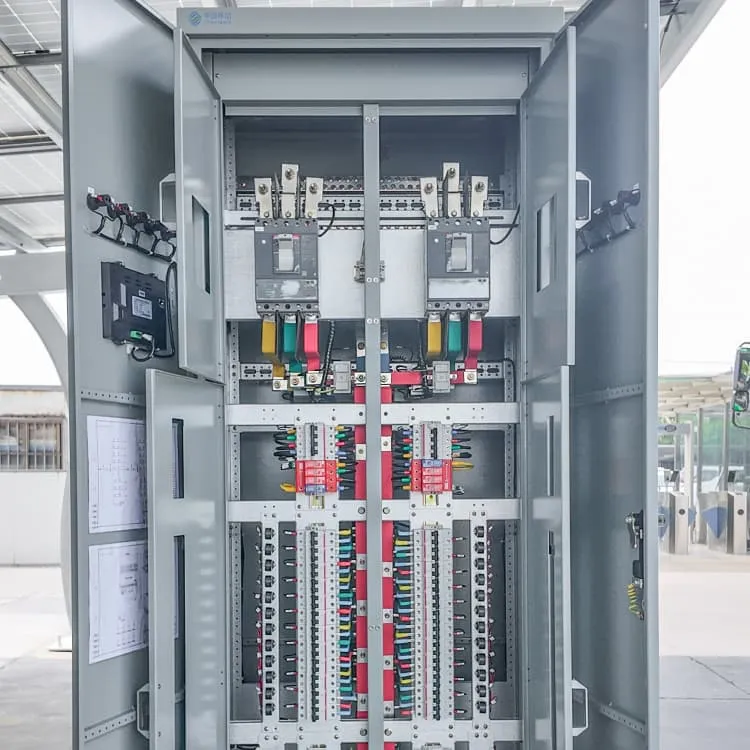

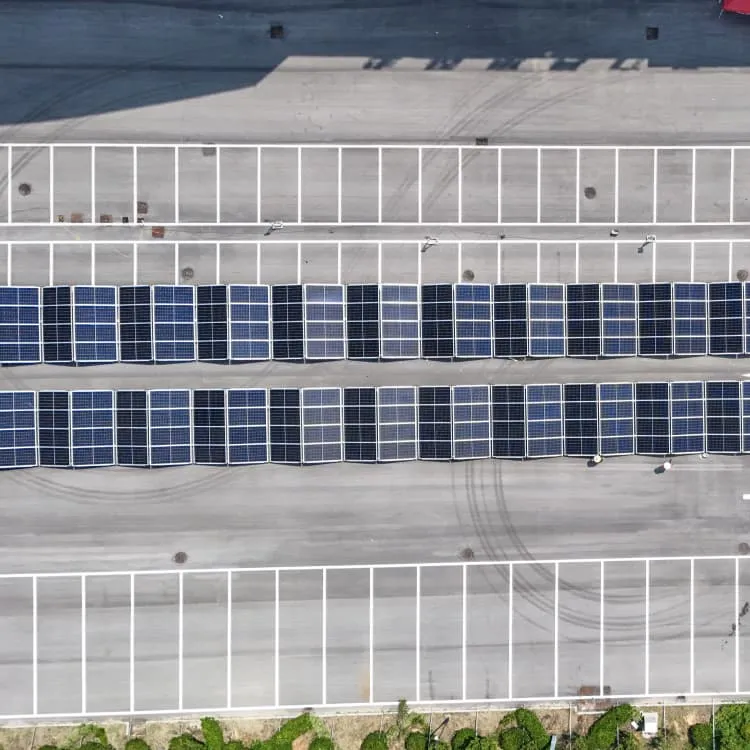

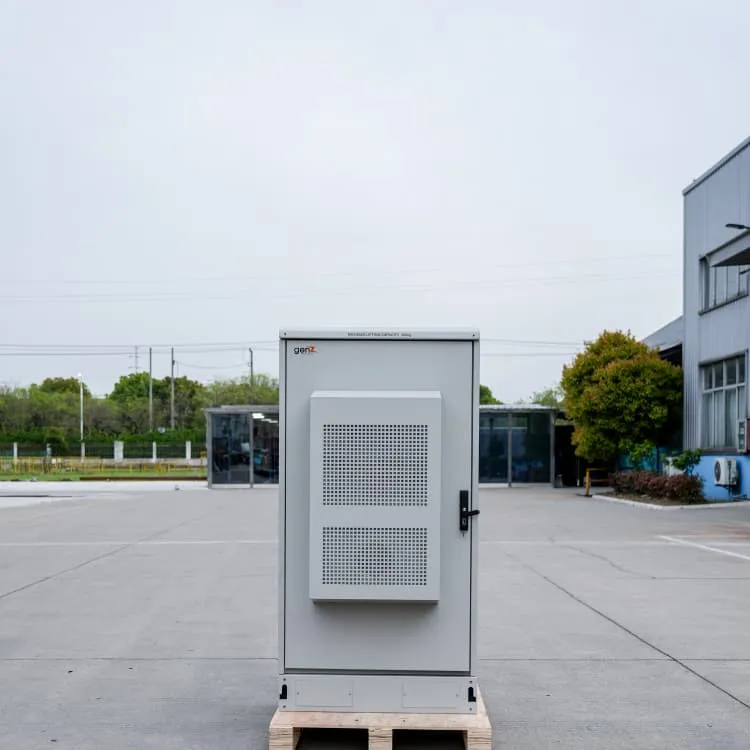

Wherever you are, we're here to provide you with reliable content and services related to What is the tax rate for chemical energy storage projects , including cutting-edge home energy storage systems, advanced lithium-ion batteries, and tailored solar-plus-storage solutions for a variety of industries. Whether you're looking for large-scale industrial solar storage or residential energy solutions, we have a solution for every need. Explore and discover what we have to offer!

The State of Play for Energy Storage Tax Credits – Publications

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income tax benefits in the form of tax credits

Carbon Capture: Tax Impacts of Utilization & Storage

By understanding the intricacies of capture, utilization, and storage, and the associated tax credits, stakeholders can better navigate the

Webinar #5: Assessments & Taxation

Provides a 15 year real property tax exemption for solar and wind (including storage when integrated into the system), farm waste energy systems, standalone energy storage, Micro

Clean Energy Tax Incentives for Businesses

These facilities or property will be treated as a 5-year property for purposes of cost recovery, leaving them with lower taxable income in the earlier years of a clean energy investment.

Tax-Exempt Entities and the Investment Tax Credit (§ 48 and

• For projects beginning construction on or after Jan. 29, 2023 or where the maximum net output is 1 MW or greater, the base tax credit is 6% of the taxpayer''s basis in the energy property or

Microsoft Word

The uses for this work include: Inform DOE-FE of range of technologies and potential R&D. Perform initial steps for scoping the work required to analyze and model the benefits that could

Renewable energy facilities and taxes | Deloitte US

For larger-scale facilities, off-take strategies may vary depending on the type of power purchaser (e.g., regulated utilities and merchant energy providers). The varying scale and usage of

The State of Play for Energy Storage Tax Credits –

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income

How much tax is paid per acre for energy storage projects?

Tax rates for energy storage projects can vary widely due to several significant factors including the geographic location, project size, and local government policies.

New advanced energy project tax credits under the

The Inflation Reduction Act, P.L. 117-169, rejuvenated and expanded an energy credit program under Sec. 48C(e) that now provides for

Comprehensive review of energy storage systems technologies,

The applications of energy storage systems have been reviewed in the last section of this paper including general applications, energy utility applications, renewable energy

Battery storage tax credit opportunities and development challenges

View information about tax credit opportunities and development challenges for battery storage.

Battery storage tax credit opportunities and

View information about tax credit opportunities and development challenges for battery storage.

Inflation Reduction Act Creates New Tax Credit Opportunities for Energy

The base ITC rate for energy storage projects is 6% and the bonus rate is 30%. The bonus rate is available if the project is under 1MW of energy storage capacity or if it meets

US energy storage sector commits to $100B

The pledge represents a more than fivefold jump in "active investments" and could enable 100% U.S.-made supply for domestic battery

Carbon Capture: Tax Impacts of Utilization & Storage

By understanding the intricacies of capture, utilization, and storage, and the associated tax credits, stakeholders can better navigate the opportunities and challenges

Guide to the Federal Investment Tax Credit for Commercial

Overview The solar investment tax credit (ITC) is a tax credit that can be claimed on federal corporate income taxes for 30% of the cost of a solar photovoltaic (PV) system that is

What is the tax rate for energy storage projects? | NenPower

The approach to project financing can dramatically influence the effective tax rate for energy storage projects. Different financing structures, such as leasing, tax equity

How much tax is paid per acre for energy storage

The path to optimizing tax obligations within the realm of energy storage projects demands a multifaceted approach, integrating regulatory

24GR0846

Many projects which are eligible for a section 45Q tax credit are also eligible for other tax credits, such as the credit for clean hydrogen production (section 45V), clean fuel

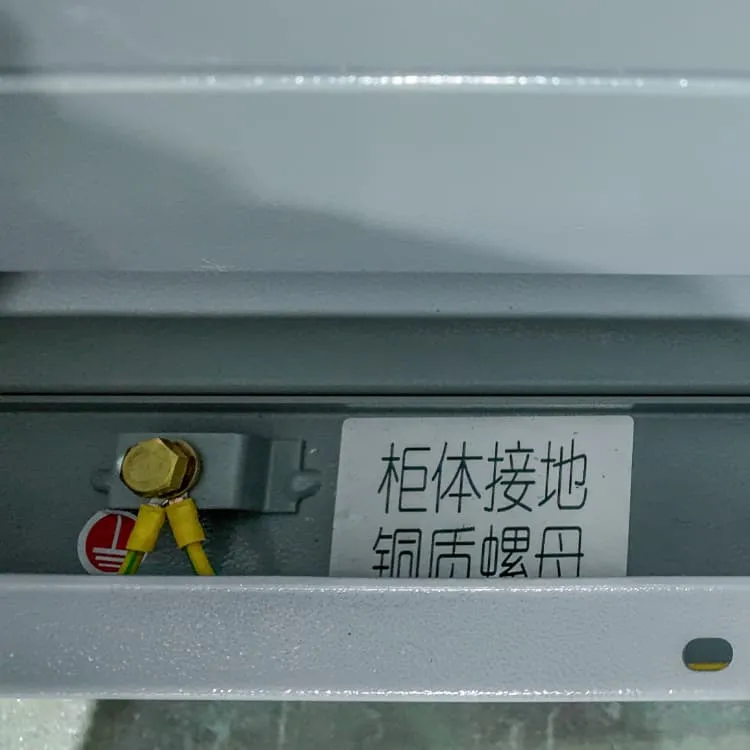

SALT and Battery: Taxes on Energy Storage | Tax Notes

In this installment of Andersen''s Sodium Podium, the authors discuss the differing property tax and sales tax considerations regarding battery energy storage systems and

The Importance of PTCs and ITCs in Renewable Energy Projects

Production Tax Credits PTCs and Investment Tax Credit ITCs are important components of renewable energy projects under the Inflation Reduction Act

Renewable energy facilities and taxes | Deloitte US

For larger-scale facilities, off-take strategies may vary depending on the type of power purchaser (e.g., regulated utilities and merchant energy providers). The

What is the tax rate for leasing energy storage power stations?

1. The tax rate for leasing energy storage power stations varies by jurisdiction, with some areas offering incentives, and in many cases, the tax implications can depend on factors

What is the invoicing tax rate for energy storage power stations?

The invoicing tax rate for energy storage power stations primarily varies based on jurisdiction and regulatory frameworks. 1. In many regions, the tax rate is influenced by specific

The story of US energy storage

If all of the energy storage-related requests for proposal (RfPs), site applications, and other utility proposals that were active at the end of 2024

Inflation Reduction Act Creates New Tax Credit

The base ITC rate for energy storage projects is 6% and the bonus rate is 30%. The bonus rate is available if the project is under 1MW of

How much tax is paid per acre for energy storage

Tax rates for energy storage projects can vary widely due to several significant factors including the geographic location, project size, and local

Federal Solar Tax Credits for Businesses

Disclaimer This resource from the U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO) provides an overview of the federal investment and production tax credits for

What is the tax rate for energy storage projects?

The approach to project financing can dramatically influence the effective tax rate for energy storage projects. Different financing structures,

§48E and §45Y tech-neutral tax credits: Guide + FAQs

The tech-neutral clean energy and manufacturing tax credit regime went into effect on January 1, 2025. Learn all about §48E and §45Y tech-neutral tax credits.

FAQs 6

How has the energy storage industry progressed in 2024 & 2025?

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income tax benefits in the form of tax credits enacted under the Inflation Reduction Act of 2022 (IRA).

What is the base tax credit for energy projects?

• For projects beginning construction on or after Jan. 29, 2023 or where the maximum net output is 1 MW or greater, the base tax credit is 6% of the taxpayer’s basis in the energy property or qualified facility (or energy storage technology).

Are IRA tax benefits a viable option for energy storage facilities?

While the vitality of the IRA tax benefits in their current form is currently subject to uncertainty given the results of the 2024 federal general election, the existing market practice for financing energy storage facilities since the IRA’s passage continues to evolve in reaction to the act’s new requirements and opportunities.

What is the ITC rate for energy storage projects?

Energy storage installations that begin construction after Dec. 31, 2024, will be entitled to credits under the technology-neutral ITC under new Section 48E (discussed below). The base ITC rate for energy storage projects is 6% and the bonus rate is 30%.

What regulatory guidance has the government released on energy storage?

Of particular importance to the energy storage industry, the government has released final regulatory guidance for the ITC (both Section 48 and 48E of the Code), prevailing wage and apprenticeship (PWA) requirements, and transferability and direct payment, as well as other guidance on the energy community and domestic content tax credit “adders.”

Who can install energy-generation & storage property?

Tax-exempt and governmental entities, such as state and local governments, Tribes, religious organizations, and non-profits may install energy-generation and storage property to meet energy demands, reach clean energy transition goals, or save money on energy costs.

Related links

- What is the tax rate for photovoltaic energy storage companies

- What energy storage projects are there

- What are the supporting components of energy storage projects

- What are the chemical energy storage devices

- What are the best energy storage projects

- What is the annual output value of energy storage projects

- What are the BESS telecom energy storage projects

- What batteries are used in large-scale energy storage projects

- What kind of battery is used for energy storage in new energy projects

- What is PCS in energy storage projects